Market

The cancer market

The global therapeutics market for cancer drugs is 166 billion USD, consisting of mix of old and newer drugs. The world’s largest cancer drug is MSD’s Keytruda® (pembrolizumab) which is indicated for several cancers and has an annual turnover of 17 billion USD.

Despite available drugs like chemotherapy and immunotherapy, a large unmet need persist for new cancer treatments that are both efficacious and safe.

Cancer remains one of the leading causes of death and is on the rise globally, in Sweden, approximately 62.000 new cases of cancers are diagnosed each year. Leukemia ranks as the number one cancer diagnosed in children and ranks as top 10 most common cancer in adults. Breast cancer is the most common cancer in women, except for skin cancers, and triple negative breast cancers with a poor outcome accounts for 15%.

An opportunity for novelty in the cancer market

Despite available and effective cancer drugs, a large unmet need persists for new cancer treatments that are both safe and efficacious.

Existing treatments often only act on one modality, for example chemotherapies damage the genes inside the nucleus of cells that are dividing, other treatments work to stimulate the immune system to destroy cancer cells (e.g. Keytruda®). AVX420 is inhibiting cPLA2α, a key enzyme which causes release of arachidonic acid resulting in the activation of multiple inflammatory and proliferative processes, involved in several processes being upregulated in cancer biology, hence acting multifaceted.

Several effective cancer treatments also act on healthy cells resulting in severe side effects. cPLA2α inhibitors including AVX420 are believed to have a more favorable safety profile based on preclinical and clinical studies.

Overall, there is a great need for new drugs with novel and effective ways of targeting cancers and with an improved safety profile.

The financial opportunity in the cancer market is substantial. The total headline value of the biopharma licensing, collaborations and joint ventures for which financial details were disclosed was $213.5 billion, up from $198 billion in 2020, with cancer-focused deals accounting for 29% of the 1,968 deals signed in 2021. Financial terms were only disclosed for 130 of the 574 cancer deals announced, with a headline figure of $73.1 billion. Biopharma M&A activity was worth $118.4 billion in 2021, down 32% compared with 2020, and cancer-focused M&A’s in 2021 were valued at $19.7 billion.

The top ten licensing deals in oncology in 2021 with a projected deal value over $1 billion

with upfront payments in the range of 30 mUSD to 1 bUSD.

(Reference Nature, biopharma dealmakers, 01 March 2022

https://www.nature.com/articles/d43747-022-00033-5

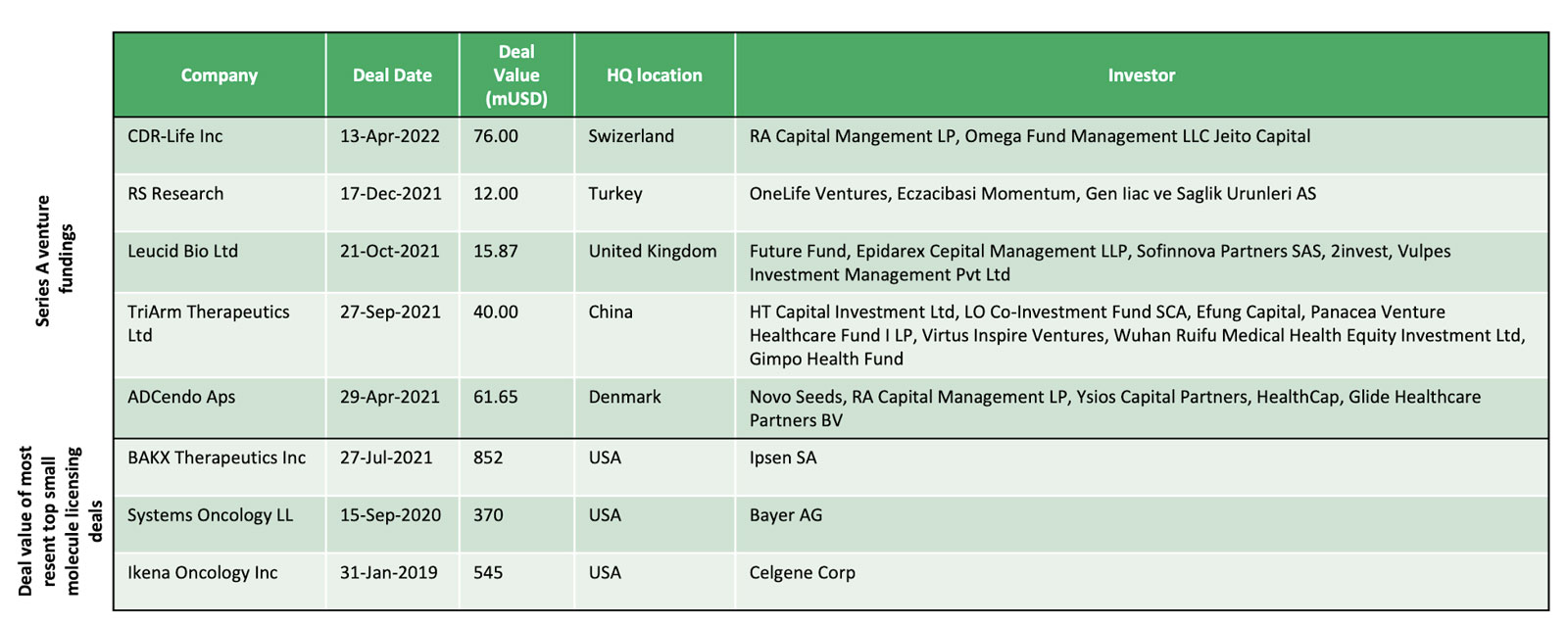

Series A funding and preclinical licensing deals in similar cases

Series A fundings in Europe for pre-clinical oncology companies/assets (blood and breast cancer) since 1. January 2018 has an average value of 27 mUSD.

The most resent deal value of top small molecule licensing deals in breast cancer and leukemia had an average deal size of 589 mUSD.